Perfect Il W9 Form Design Today

Understanding the Importance of W9 Forms

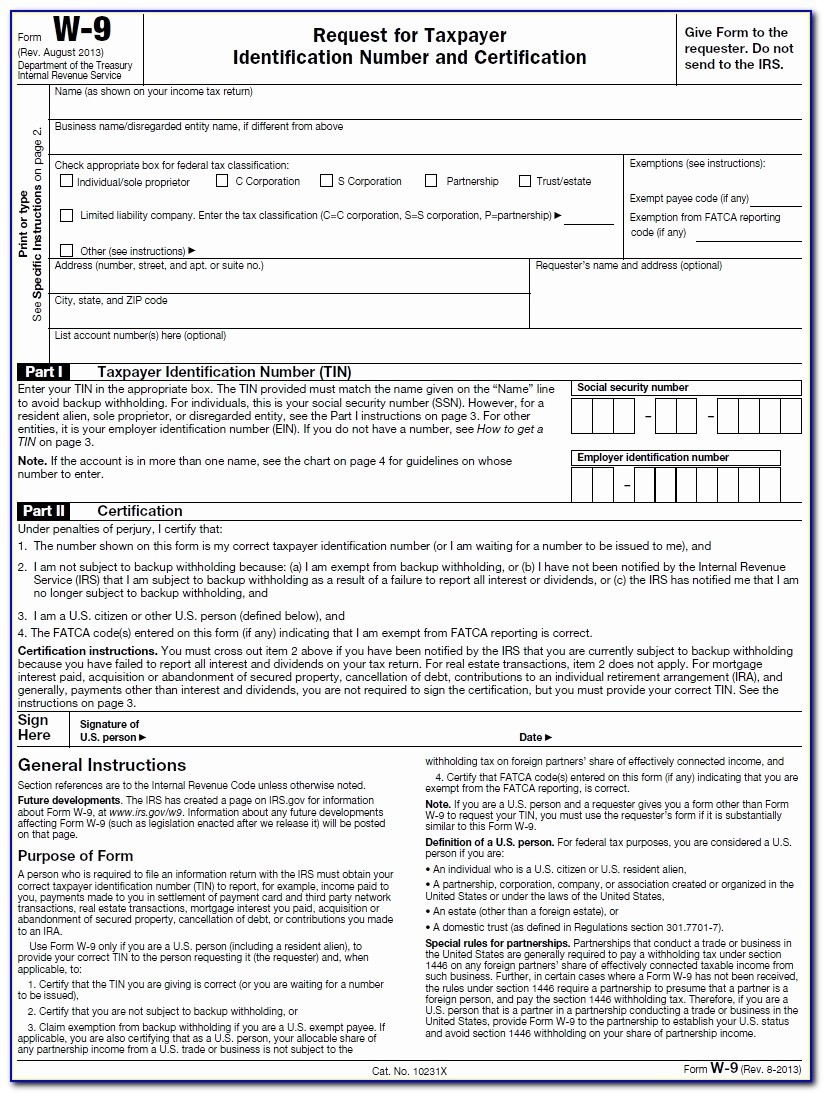

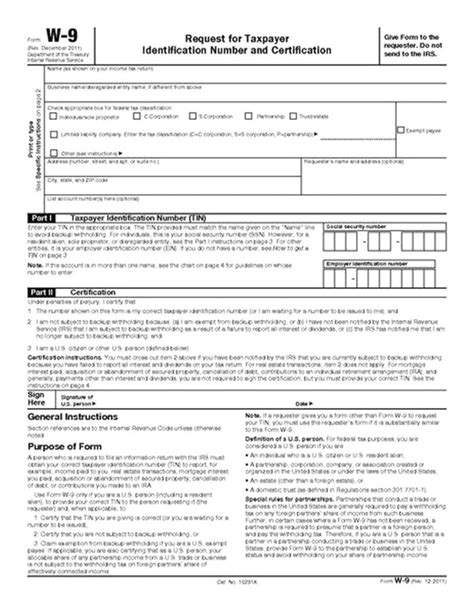

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by businesses and organizations to collect necessary information from independent contractors, freelancers, and vendors. This form is essential for tax purposes, as it provides the required details to report payments made to these individuals or entities to the Internal Revenue Service (IRS). In this blog post, we will delve into the world of W9 forms, exploring their significance, design, and the information they require.

Key Components of a W9 Form

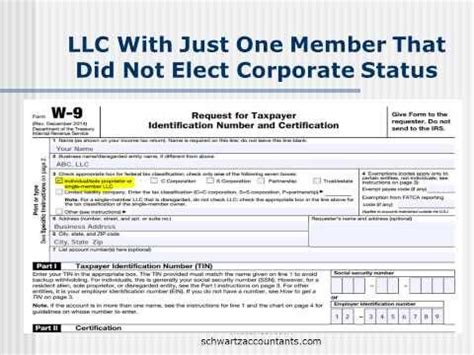

A standard W9 form includes several key components that must be completed accurately by the independent contractor or vendor. These components include: * Name and Business Name: The individual’s or entity’s name and business name, if applicable. * Business Entity Type: The type of business entity, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC). * Address: The individual’s or entity’s address. * Taxpayer Identification Number (TIN): The individual’s or entity’s TIN, which can be a Social Security Number (SSN) or an Employer Identification Number (EIN). * Certification: A certification statement that the information provided is accurate and the individual or entity is not subject to backup withholding.

Designing a W9 Form

When designing a W9 form, it is essential to ensure that it is easy to read and understand. The form should be well-organized, with clear headings and labels. The following are some tips for designing a W9 form: * Use a standard font, such as Arial or Times New Roman. * Use bold text to highlight important information, such as headings and labels. * Use white space effectively to make the form easy to read. * Include instructions on how to complete the form, if necessary.

Creating a W9 Form

Creating a W9 form can be a straightforward process, especially with the help of tax software or online templates. The following are the steps to create a W9 form: * Determine the business entity type and TIN required. * Gather the necessary information from the independent contractor or vendor. * Use a W9 form template or tax software to create the form. * Review and verify the information provided to ensure accuracy.📝 Note: It is essential to ensure that the W9 form is completed accurately and signed by the independent contractor or vendor to avoid any penalties or fines.

Best Practices for Managing W9 Forms

Managing W9 forms effectively is crucial for businesses and organizations. The following are some best practices for managing W9 forms: * Store W9 forms securely, either electronically or in a locked cabinet. * Update W9 forms regularly to ensure that the information is current and accurate. * Verify the TIN and business entity type to ensure compliance with IRS regulations. * Use W9 forms consistently for all independent contractors and vendors.

| Business Entity Type | TIN |

|---|---|

| Sole Proprietorship | SSN |

| Partnership | EIN |

| Corporation | EIN |

| LLC | EIN |

In summary, W9 forms are a crucial component of tax compliance for businesses and organizations. By understanding the key components, designing a W9 form effectively, creating a W9 form, and managing W9 forms best practices, businesses and organizations can ensure that they are in compliance with IRS regulations and avoid any penalties or fines.

What is the purpose of a W9 form?

+The purpose of a W9 form is to collect necessary information from independent contractors and vendors, including their name, business name, address, and taxpayer identification number, to report payments made to them to the IRS.

Who needs to complete a W9 form?

+Independent contractors, freelancers, and vendors who provide services to businesses and organizations need to complete a W9 form to provide the necessary information for tax purposes.

What are the consequences of not completing a W9 form accurately?

+The consequences of not completing a W9 form accurately can include penalties, fines, and delays in processing payments. It is essential to ensure that the W9 form is completed accurately and signed by the independent contractor or vendor to avoid any issues.