10 Usaa Payment Facts: Ultimate Benefits Guide

Introduction to USAA Payment Facts

USAA, or the United Services Automobile Association, is a financial services company that offers a wide range of products, including insurance, banking, and investment services. The company is known for its excellent customer service and comprehensive benefits, which are designed to meet the unique needs of military personnel and their families. In this article, we will explore 10 key USAA payment facts that highlight the ultimate benefits of using USAA’s payment services.

Understanding USAA Payment Services

USAA offers a variety of payment services, including online bill pay, mobile payments, and credit cards. These services are designed to make it easy for members to manage their finances and make payments on time. With USAA’s payment services, members can pay bills, transfer funds, and make purchases with ease. Some of the key benefits of USAA’s payment services include: * Convenience: USAA’s payment services can be accessed online or through the USAA mobile app, making it easy to manage finances on the go. * Security: USAA’s payment services are protected by robust security measures, including encryption and two-factor authentication. * Rewards: USAA’s credit cards offer rewards programs that can help members earn cash back, points, or travel miles.

10 Key USAA Payment Facts

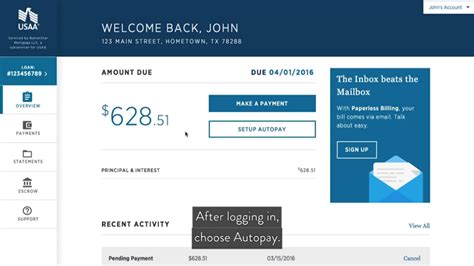

Here are 10 key USAA payment facts that highlight the ultimate benefits of using USAA’s payment services: * Fact #1: No Foreign Transaction Fees: USAA’s credit cards do not charge foreign transaction fees, making them a great option for military personnel who are stationed abroad. * Fact #2: Competitive Interest Rates: USAA’s credit cards offer competitive interest rates, which can help members save money on interest charges. * Fact #3: Cash Back Rewards: USAA’s credit cards offer cash back rewards programs that can help members earn up to 1.5% cash back on all purchases. * Fact #4: No Annual Fees: Many of USAA’s credit cards do not charge annual fees, making them a great option for members who want to avoid extra charges. * Fact #5: Travel Insurance: USAA’s credit cards offer travel insurance, which can provide protection against trip cancellations, interruptions, and delays. * Fact #6: Purchase Protection: USAA’s credit cards offer purchase protection, which can provide protection against theft, loss, or damage to purchased items. * Fact #7: Online Bill Pay: USAA’s online bill pay service allows members to pay bills online, which can help them avoid late fees and penalties. * Fact #8: Mobile Payments: USAA’s mobile payments service allows members to make payments using their mobile devices, which can provide an extra layer of convenience. * Fact #9: Credit Score Tracking: USAA’s credit score tracking service allows members to monitor their credit scores, which can help them stay on top of their credit health. * Fact #10: Dedicated Customer Service: USAA’s dedicated customer service team is available 24⁄7 to provide assistance with payment-related issues.

Benefits of Using USAA Payment Services

The benefits of using USAA payment services are numerous. Some of the key benefits include: * Convenience: USAA’s payment services are designed to be convenient and easy to use. * Security: USAA’s payment services are protected by robust security measures. * Rewards: USAA’s credit cards offer rewards programs that can help members earn cash back, points, or travel miles. * Competitive Interest Rates: USAA’s credit cards offer competitive interest rates, which can help members save money on interest charges.👍 Note: USAA's payment services are only available to USAA members, who must be active or former military personnel, or their families.

Comparison of USAA Payment Services

Here is a comparison of USAA’s payment services with other financial institutions:

| Feature | USAA | Other Financial Institutions |

|---|---|---|

| Foreign Transaction Fees | No fees | Fees may apply |

| Interest Rates | Competitive rates | Higher rates may apply |

| Cash Back Rewards | Up to 1.5% cash back | Lower rewards may apply |

In summary, USAA’s payment services offer a wide range of benefits, including convenience, security, rewards, and competitive interest rates. By using USAA’s payment services, members can make payments with ease, earn rewards, and save money on interest charges. Whether you’re a military personnel or a family member, USAA’s payment services are designed to meet your unique needs and provide you with the ultimate benefits.

What are the benefits of using USAA payment services?

+The benefits of using USAA payment services include convenience, security, rewards, and competitive interest rates.

Are USAA payment services available to non-military personnel?

+No, USAA payment services are only available to USAA members, who must be active or former military personnel, or their families.

How do I access USAA payment services?

+You can access USAA payment services online or through the USAA mobile app.