Military

10 Money Facts Lebanon: Ultimate Savings Secrets

Introduction to Lebanon’s Financial Landscape

Lebanon, a country known for its rich history, cultural diversity, and resilience, faces unique financial challenges. Understanding the local economy and adapting to its nuances is crucial for anyone looking to navigate its monetary landscape effectively. Whether you’re a local or an expat, managing your finances wisely can make a significant difference in your quality of life. This article delves into essential money facts about Lebanon, offering insights and secrets to help you save and thrive in this beautiful yet economically complex country.

Understanding Lebanon’s Currency

The Lebanese pound (LBP) is the official currency, but the US dollar is widely accepted and used in parallel. This dual currency system can be both convenient and confusing. Exchange rates can fluctuate, affecting the purchasing power of your money. It’s essential to stay updated on the current exchange rates to make informed financial decisions.

Economy and Inflation

Lebanon has faced significant economic challenges, including high inflation rates. The cost of living, especially in cities like Beirut, can be quite high. Understanding how inflation works and its impact on your savings is crucial. Investing in assets that historically perform well during inflationary periods, such as real estate or certain commodities, might be a strategic move.

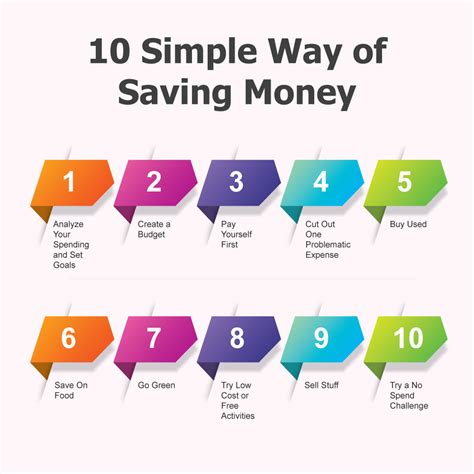

Saving Strategies

Given the economic conditions, having a solid saving strategy is vital. Here are some points to consider: - Diversify Your Savings: Spread your savings across different currencies and investment types to minimize risk. - Use High-Interest Savings Accounts: If available, consider placing your savings in high-interest accounts to counteract inflation. - Invest Wisely: Look into investments that are likely to grow in value over time, such as education, personal development, or assets that historically appreciate.

Banking in Lebanon

The banking system in Lebanon is sophisticated, with many banks offering a range of services. However, banking regulations and interest rates can change, so it’s crucial to stay informed. Some banks offer attractive interest rates on deposits, which can be a good saving strategy, especially for short-term goals.

Taxation

Understanding tax laws in Lebanon is important for managing your finances effectively. The country has a relatively complex tax system, with various deductions and exemptions available. Consulting with a tax professional can help ensure you’re taking advantage of all the savings opportunities available to you.

Cost of Living

The cost of living in Lebanon, particularly in urban areas, is relatively high. Expenses such as housing, food, and transportation can quickly add up. Creating a budget that accounts for these expenses and leaves room for savings is essential. Consider ways to reduce your expenses, such as finding affordable housing, cooking at home, and using public transport.

Investment Opportunities

Despite the challenges, Lebanon offers various investment opportunities, including: - Real Estate: Historically, real estate has been a popular investment in Lebanon, offering potential long-term gains. - Business: Starting or investing in a business can be lucrative, especially in growing sectors like technology and tourism. - Education: Investing in your education or the education of your family members can lead to better job opportunities and higher salaries.📝 Note: It's essential to conduct thorough research and consult with financial advisors before making any significant investment decisions in Lebanon.

Financial Technology and Digital Payments

The use of financial technology (FinTech) and digital payment methods is on the rise in Lebanon, offering convenience and potential cost savings. Mobile banking apps, online payment services, and digital wallets can make managing your finances more efficient and reduce the need for physical cash.

Conclusion and Future Outlook

Navigating the financial landscape of Lebanon requires patience, knowledge, and adaptability. By understanding the unique aspects of the economy, currency, banking system, and investment opportunities, you can make informed decisions to secure your financial future. Whether you’re saving for a short-term goal or planning for long-term financial stability, the key is to stay informed and be proactive in managing your finances.

What is the best way to save money in Lebanon?

+Diversifying your savings across different currencies and considering high-interest savings accounts or investments that grow in value over time can be effective strategies.

How does inflation affect savings in Lebanon?

+Inflation can reduce the purchasing power of your savings. Investing in assets that historically perform well during inflationary periods can help maintain or grow the value of your savings.

What are some good investment opportunities in Lebanon?

+Real estate, business investments, and education are among the potential investment opportunities in Lebanon. It’s crucial to research and consult with financial advisors before making any investment decisions.